It feels like our updates are coming thick and fast at the moment – the energy across the teams as we see the market improve week on week is infectious and it is fantastic to share our positive news with the market.

Last week was half term and we would normally expect a quieter run in and out of this period – not so! The HR job market has remained consistently good which adds further encouragement. Following the government’s outline for our “unlocking” this week there has been a real sense of hope and new energy in the air. The days are getting slightly longer and I don’t know about you, last weekend certainly felt like spring had arrived and how refreshing it was!!

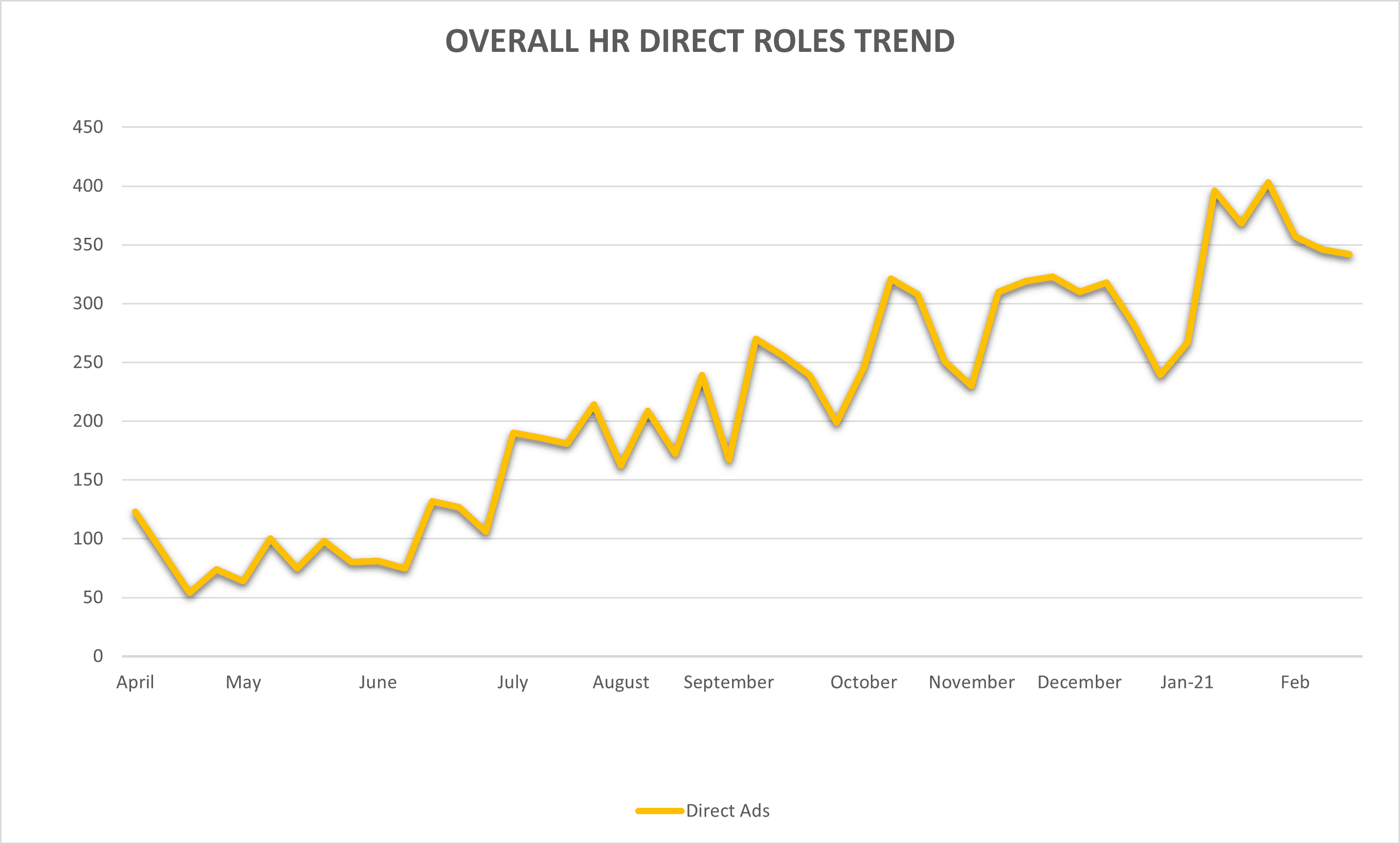

This week we hear from Sam Clark covering the Reward and Analytics market and John O’Brien sharing his usual passion for the payroll sector. As a whole, HR job numbers remain steady and direct hiring is at pre-COVID levels, direct teams are beginning to need to bolster their own ranks as volumes of hiring increases and that in turn sees more roles come to market through agency. Our professional services team are almost back to pre-COVID HR job numbers – having been the worst hit at the height of the pandemic so this is wonderful news. Wellbeing roles are being benchmarked in abundance across PS too. HR roles in the city had been heavily led with demand for HR interims and this has swung in recent weeks with more perm HR jobs being signed off. There is significant hiring activity across the investment banks specifically. The increase in permanent HR jobs is also reflected across the rest of UK industry at all levels and dare I say it we are seeing improvements in the consumer sector as well. Our exec practice is reporting a market for senior HR roles that is also pretty active and so in summary the improvements continue.

(Source: Vacancysoft)

There is still some way to go when you consider the entire job market and so we welcomed the news from the CIPD at the beginning of this week that UK companies indicated their strongest employment intentions since onset of the Covid-19 pandemic – long may this continue…

Payroll Insight

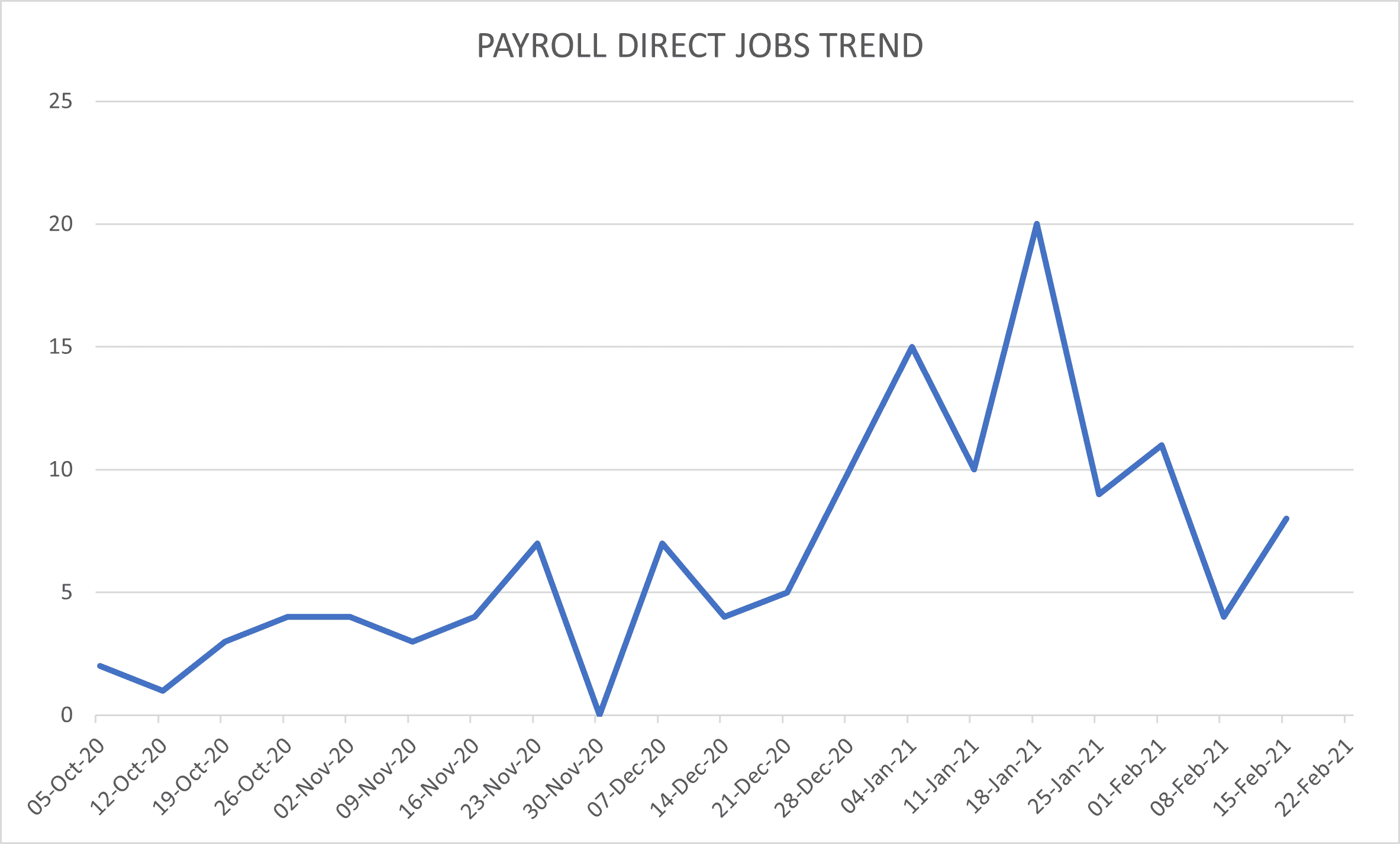

The Payroll & Benefits division have seen a steady increase in their job flow since the Christmas and New Year break and we are currently working at 75% of our instructions compared to this time last year, which is such an encouraging sign.

Our market has clearly been affected by COVID but the quality of positions we have worked on have been excellent and the calibre of candidate on the open market reflected this! At no point have we felt in a recession type mood. In fact, it has been the exact opposite.

Financial & Professional Services

Our Financial and Professional Services clients have become one of the key drivers of our momentum this year and we have seen a number of global asset management, PE firms and investment banks wanting to set up their “Payroll Shop” in London as they believe that the best payroll talent globally sits in the UK. I have to agree with them. We have also had a number of our existing clients come back to us with positions that have been created due to an increase in profits and growing their offerings across EMEA and in particular APAC.

The salaries on offer and the diverse skill sets are making massive waves in the industry and I believe that we have increased our reputation as having the best jobs on offer and continuing to provide that luxury feel to payroll & benefits recruitment.

(Source: Vacancysoft)

Commerce & Industry

The Commerce & Industry division has had to be smart and work even closer with our HR colleagues to maximise our focus on the clients that are navigating their way through this tough market. We have had major success with life sciences, bio medical, pharma, IT/tech and even hospitality who are being agile and bucking the negative trends that we are hearing in the press.

The current rise in our job portfolio has simply come from our reputation as being the leading payroll consultancy within Financial and Professional Services and this reputation has now put our Commerce & Industry colleagues firmly on the map with some amazing wins in both new and existing clients.

Interim

The last quarter was a steady one for interim. We saw a consistent stream of work come in from financial services with a number of contract extensions and temp to perm placements, as clients realised the importance of payroll and wanted to retain their talent. Commerce clients were still hiring and furlough expertise was a skillset in high demand. The impact of IR35 is still looming in the coming months, however clients are wanting more for their money with a focus on more fixed term appointments then day rate, even in the project space which would typically be day rate only territory. Candidates are more flexible in terms of their requirements, but remote working remains the priority and a key requirement even above salary.

What has become clear to me is that people want to talk and communicate more than ever. We are all out of our comfort zones and we have had to adapt and face constant change in the last year and to be honest I believe that this will continue for some time. There is light at the end of the tunnel, however, and the payroll world has grown and embraced these challenging times for the better.

Reward & Analytics Insight

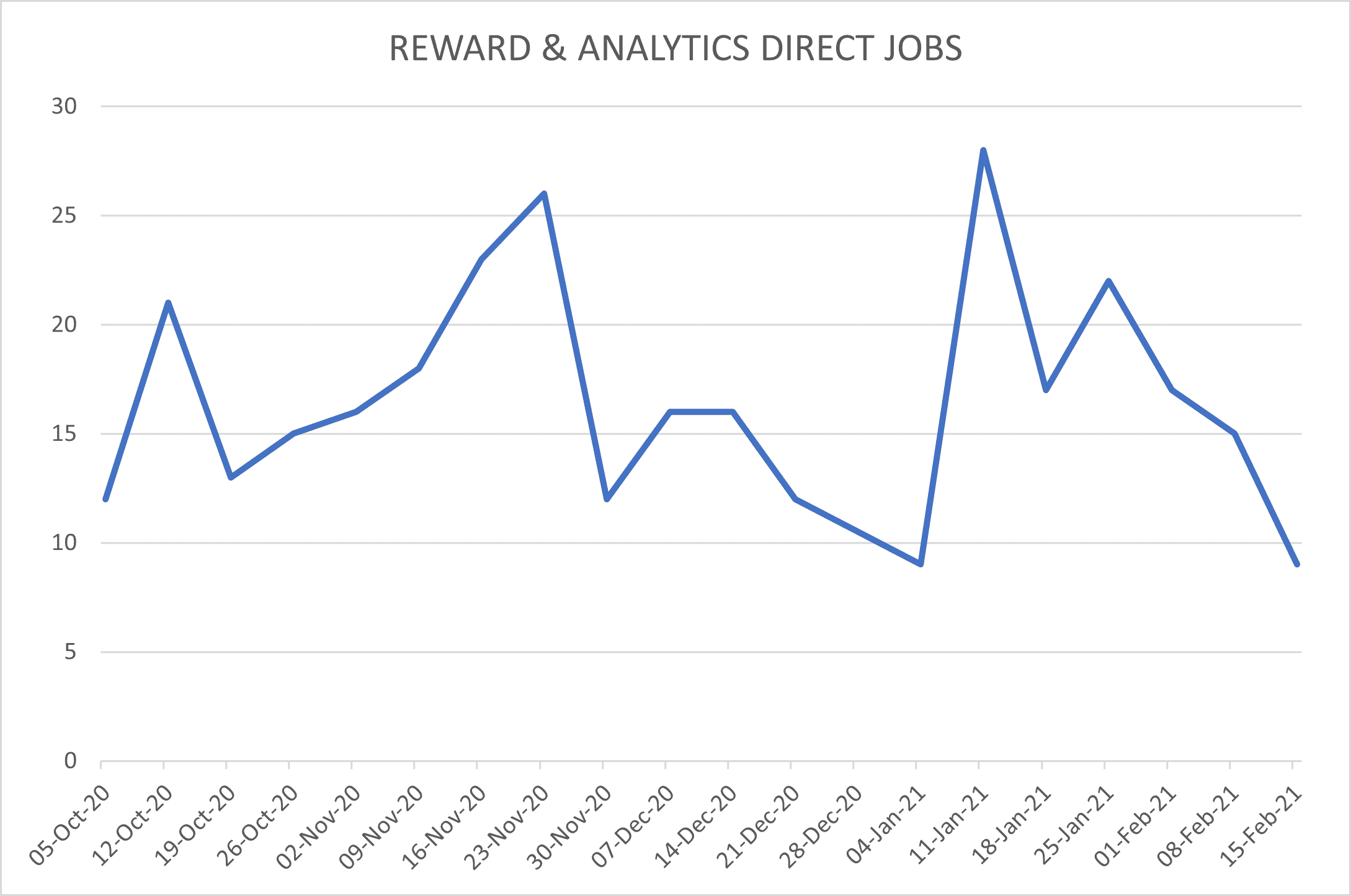

It’s been an interesting start to 2021. We have seen a recent focus on Reward Partner, Senior Manager level reward appointments and more executive compensation- centric hiring given the spotlight on exec remuneration in a recession environment. There are lots of candidates at the Head of level available in the market, and hence more competition but less roles.

More conversations and roles are coming through in banking to support CRD V and IFD regulation changes in banks and investment management firms. Interim support has been required to implement changes and permanent hiring to manage business as usual regulations, reporting and day to day management. Change and transformation roles and BAU maternity cover roles are in demand.

There has been an emphasis on direct hiring due to COVID but there appears to be less transparency around pay and budgets, so companies are losing candidates at the end of process when discussions around PAYE vs limited are happening and so are falling down.

(Source: Vacancysoft)

Reward & Analytics in Commerce & Industry

We are seeing more positivity overall and companies seem happy to start projects which they have had on hold such as benefits / system implementations and job grading projects. It is still relatively quiet at the mid to senior level, however, more people are making tentative moves in their job searches which inevitably means more jobs will open up. The junior end of the market has been a lot busier with replacement and additional headcount hires on the permanent side and fixed term contracts to support project work which is kicking off. Technology and pharmaceutical businesses remain the busiest sectors with new opportunities.

Growing demand for HRIS and Analytics

At the junior end of the market, we are not seeing demand for reward interims but junior HRIS and HR analytics roles are busier. Teams are wanting to bolster analytical and reporting capability in order to make broader strategic people decisions. We are certainly seeing more systems roles – the market seems to be Workday and SuccessFactors centric.

Bonuses

Many companies reduced or cancelled annual bonuses for the 2019/20 performance year in response to the pandemic and deferred the cash element of annual bonuses and/or paid bonuses in shares to address short-term cash flow concerns. From conversations, we will expect a similar approach for 2020/21 with bonuses to reflect the impact of the pandemic on the business and wider workforce. Of course, some firms are seeing a real split in performance with some business lines reporting a relatively strong result whilst others are underperforming – this will be interesting to see how this plays out from a bonus perspective and the impact on retention.

Interim

Understandably, there has been less emphasis on extra interim support for year-end type contracts. Salary reviews have been scaled back and businesses are having to look closely at the justification for increases in base salary or variable pay for executives. As such, many businesses are adopting a standardised approach across the rest of the business such as small increments across the board and increases for promotions. There is also growing evidence of junior benefits hiring on the interim side to support projects.

We are experiencing increasing demand for maternity cover contracts, although minimal roles are coming through on day rate given the impending impact of IR35.

Benefits and Wellbeing

Benefits and wellbeing are a focus for the year ahead with businesses starting to think about their total reward offering. We are speaking with businesses who are planning for the new financial year and are looking to review and improve their existing plans and smaller firms who are looking to introduce more comprehensive benefits offerings to their employees. This is particularly prevalent in businesses which have traditionally been more cash focussed and where there’s a new demand to introduce better insurance and healthcare. Wellbeing remains high on the HR agenda – financial wellbeing becoming more of a focus of businesses in the year ahead.