Welcome to the first of our new fortnightly updates. In response to feedback from our customers we are trying new initiatives to keep you as best abreast of what is happening in the market as possible. We are very mindful just how tough it is in the job market at the moment and so we hope that this will go some way to help to keep you informed. We will be giving you a generic overview and then our sector leads will be providing their insight and thoughts on a rolling basis.

Thank you to those of you who completed our brief online survey recently. It gave us some valuable insights confirming both peoples current state of mind and experiences of the job market currently. A full report from the survey can be found here: Direct hiring and Recruitment Agency Usage in a recession

2020 so far

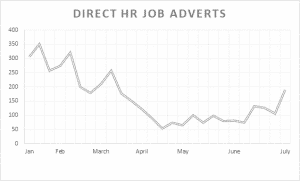

Job numbers across the HR and Payroll space started to fall as early as January and we aren’t sure whether this was related to Brexit, early global news re Covid or simply broader economic forces at play. Unsurprisingly, it doesn’t seem that material anymore does it? The onset of Covid in early March saw job numbers plummet and then bottom out in late April / Early May. We have seen a very slow improvement in job activity from that date. The agency flow of Payroll, Reward and HR jobs was hit slightly later than the direct jobs seen in the graph below (Source: Vacancysoft). We maintained job numbers until March and have followed the pattern seen with direct hiring since then.

I have never experienced a job market which has seen such a sudden and sharp demise. It is quite simply a scenario that we have not seen before and therefore understanding how the market for HR jobs will recover will be unpredictable. The Interim (day rate / temp) market seems to have taken the biggest hit which is very unusual – more on this below. July looks to be improving markedly although there is some indication that jobs may tail off again in August with the onset of the usual summer holiday season. We have all been through so much already and almost everyone we speak to is desperate to get away and have some much needed downtime. If this is the case then we expect to see further improvements through September and October.

Job Applications

Given the sudden erosion of jobs for us to partner our customers with, we had to make the difficult decision to protect the business and furlough a large number of the Oakleaf team. We now find ourselves in the tricky situation which is common place in a downturn. Supply of jobs is poor and demand for jobs is high. In the last 8 weeks we have seen unprecedented volumes of job applications. One vacancy that we advertised attracted 1370 applications! We have noticed that this is equally true of applications for direct adverts and people have shared their frustration that they are just not hearing back from those applications. We need to maximise our use of the furlough scheme while jobs numbers are at their lowest and we will be filtering staff back from September. This does mean that our ability to respond to everyone and in the usual time frames is just not possible. We apologise that you may not be getting the personal time you deserve with a member of the team and we hope to resolve this in the coming months. The team are working incredibly hard to do what they can in the time that is afforded to them.

The Interim Market

In April this year Brittany Newell was promoted to lead Oakleaf’s Contingent Interim practice.

As the interim world has been turned on its head we thought it would be apt to start our updates with some further detail on what is happening in this space:

Since March 16th we have notice an increase of fixed term contracts which equates to 64% of new interim HR jobs listed during this time. We have identified volume activity is at £25,000 – £40,000 level – HR Administrators through to HR Advisors and at head of HR / Senior HR Business partners circa £80,000 – £100,000. The past six weeks we have seen an increase in HR project / transformation positions. Specifically restructuring, looking to improve operational effectiveness and to design new policies and procedures to align with remote working. Internal recruitment roles have been very quiet over the past few months. We have only had two interim recruitment focused positions since lockdown. Payroll has continued to be consistent throughout this period, organisations have extended interim resources to assist teams with changes to peoples salaries during COVID19 and furlough payments.

We have noticed the executive interim HR jobs market has been quiet with a number of projects being placed on hold. July has seen us start to have initial conversations with clients surrounding large scale transformation and change projects which thy are looking to kick off come September.

Our commerce client base has remained consistent throughout the past five months contributing 44% of new positions within the interim space. Our TMT (Tech, Media, Telco) brand has been our strongest performing in terms of new vacancies at 24% with financial services not far behind at 22%.

April saw a large portion of LTD contracts finish in line with what would have been the go live of IR35 in the private sector. Individuals who operate via their limited company have been hit hardest throughout this period. Organisations who were prepared for IR35 to come into play April 2020 made the decision to not engage services from LTD despite the extension from HMRC to April 2021. This has been particularly common with large multinational / FTSE organisations.

Rather than lose good talent organisations have asked some contractors to reduce their days which has had a positive response. People have been flexible given the current climate, some reducing day rates when being offered extensions.

Simon Hunt

Managing Director

Tel: 0207 220 7030 | Mob: 07739 804159