In the third of our series of market insights we will be looking at the Payroll and Reward & Analytics markets.

Market overview

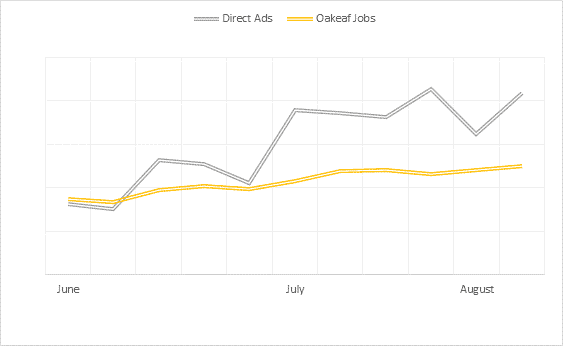

On the whole the first half of August has been incredibly volatile. Our prediction that job numbers may be impacted by the annual seasonal low looked correct as the number of direct adverts dropped heavily in the first week of the month. Yet by the end of week two the numbers had bounced back to their previous levels and this low and resulting high over what is very short period of time has resulted in Oakleaf’s job number remaining static which we are unsurprisingly viewing as incredibly positive at the moment.

We have been keeping our ears to the ground over recent months and there seems to be a real sense of optimism in the market now. A recent APSCo report summarising data from Vacancysoft highlighted that vacancies across the white collar work force were down on average about 40%, regionally (outside of London) that is 50% and we know that HR hiring is down 65-70%. Their predictions are that these numbers will improve by approximately 50% in the second half of the year. Let’s hope this prediction comes to fruition! Their data also mirrored ours in that the two sectors seemingly proving the most resilient at the moment are financial services and tech, media and telco (TMT).

A slight change in the interim market too which is refreshing – we have seen our first real influx of change and transformation roles and a few more true interim roles as opposed to fixed term options.

This week I am delighted to introduce both our Payroll practice lead (promoted to Associate Partner in April) – John O’Brien who is the go to expert when it comes to everything payroll and Sam Clark (promoted to Senior Manager in April) who stepped into Jamie Newton‘s shoes to run Oakleaf’s market leading Reward practice following Jamie’s move into a broader and more complex Global Reward Partner role.

Payroll Market Update

The Payroll market continues to grow from strength to strength and we have now seen close to 250 clients in London and the South East alone looking to upskill their payroll talent which has been very encouraging. We at Oakleaf have seen a surge in job numbers across all sectors in the past 10 weeks which has led to some amazing results and achievements.

At the start of lockdown payroll professionals were banging the drum and giving high fives at the concept of still “getting the UK paid” amidst all the economic and business chaos. A key pressure on the payroll community was that they were not a business community used to, or in some cases from a risk and data security perspective, being allowed to work from home. The need to make that transition very quickly was a challenge and has led to a complete change in working practice for a majority of payroll individuals and teams.

As the new reality set in the initial enthusiasm has waned and payroll professionals are being less vocal across the social media landscape. A large number have felt completely overwhelmed with the workload, working from home is starting to get to them and managing their teams remotely is tough. The added complexity of managing a payroll with the extra responsibilities of furlough, reduced pay, pensions, pensions holidays, changes to holiday, benefits amendments, bonus deferrals and changes to sales incentives is tough – the list goes on! Even in a BAU environment there are issues with vendors and typically their communication – it would seem that this has only got worse and highlights the need to improve service levels from these suppliers. The “race to the bottom” mentality is still prevalent. Systems as a whole are coming under scrutiny – maybe this change will finally see the improvements so desperately required!?

That may sound slightly gloomy – all is not lost! Payroll has always had the possibility of being a hybrid and diverse function and over the past 18 months we have seen this in full swing when recruiting for our customers. The market has changed, payroll professionals are having to evolve with it and clients’ perceptions of payroll have definitely changed for the better. HR, reward and payroll are becoming far more inclusive and collegiate. Payrollers are now commonly involved in onboarding, induction, starter & leaver processes, benefits (renewals, gender pay gap and other reporting, benchmarking), HR projects and broader HR systems (where the payroll capability is most often the fundamental element!).

It’s such an exciting time for the industry and people must embrace the new ways/styles of working, have a voice and remember that payrollers have a seat at the table.

Roles of late have been quite diverse – a few further insights:

- Senior hiring across financial & professional services and the salaries tied to these roles have risen by 20% to 30%. Not all have had global or EMEA responsibilities some have been just UK. Payrolls have not been large. Typically 150 to 450 employees max.

- Across commerce most hiring has been junior to mid-level. Candidates at this level are nervous in regard to moving jobs and so it is proving tricky to get hold of the best talent. Salaries have risen by 10% to 15% and benefits are improving.

- Permanent hiring is picking up slowly and many customers are extending existing interim contracts to assist in managing the ongoing change in payroll currently.

Furlough had put the brakes on the temporary payroll market and we are just beginning to see more activity across interim hiring which is a welcome relief.

Reward & Analytics

The Reward market has certainly been interesting since lockdown was announced. Financial services has been buoyant as confidence in the market has remained and hiring has continued to be steady. FY Q1 saw the usual increase in permanent hiring post bonus pay outs with replacement roles across the Analyst, Manager and Head of level across banking and asset management in particular. There has been a cautiousness with new hires, with a need to take stock before pressing go on additional headcount to avoid any unwanted scrutiny.

The last couple of months has seen a positive shift across broader commerce especially in technology and pharmaceuticals sectors with the economy starting to open up again, confidence is growing and with that so is hiring. In normal years, towards the end of July and beginning of August, hiring does tend to slow down as reward professionals take well-earned breaks before silly season begins and companies gear up and prepare for year end. That trend does seem to be following suit even during this time and the positive conversations we are having with clients indicates that roles are being pipelined just as they have in previous years.

Covid has undoubtedly put a halt to many projects which would have required interim reward and HRIS project support at the beginning of the financial year when we normally would have seen these kick off. From our conversations with customers, H2 will be when these delayed projects will be reviewed and begin to open up the market again which of course will also coincide with year-end salary review contracts – we anticipate a busy second half of the year in the interim reward market!

This pay and bonus season will be interesting; reward professionals will need to balance the books whilst also incentivising their people and managing their executives and the broader business fairly. Businesses will need strong reward leadership and perhaps extra support as they guide HR and their respective businesses through imminent change and transformation with re-orgs and workforce design. There is also a focus on reviewing reward policies and processes in relation to pay scales and fair pay. Benefits strategy is also on the agenda with some innovative work being done and investment across the physical, mental and financial wellbeing space.

Our next insight will focus on our Commerce & Industry and Regions businesses.

Simon Hunt

Managing Director

Tel: 0207 220 7030 | Mob: 07739804159